CleanSpark Inc. (Nasdaq: CLSK), America's Bitcoin Miner, announced the appointments of Scott Garrison as chief operating officer and Taylor Monnig as chief technology officer.

Garrison, previously SVP of growth, and Monnig, previously SVP of mining technology, have been critical in CleanSpark's remarkable growth. Garrison has led business development and construction of the Company's data centers, while Monnig has been instrumental in developing the programs and leading the teams behind the Company's industry-leading uptime and miner performance.

"Scott and Taylor are examples of CleanSpark's commitment to excellence and the 'CleanSpark Way'. Their leadership and grit have been instrumental in positioning CleanSpark as the top operator at scale in the industry," said Zach Bradford, CEO. "I speak often about our best-in-class teams and Scott and Taylor have both helped build and lead these teams to great heights. They are instrumental to our continued success as our teams grow and gain even greater expertise to match the task ahead of us on our path to 50 EH/s and beyond. I greatly look forward to this next phase in CleanSpark's journey as we work together to continue delivering value to our shareholders and the greater bitcoinecosystem."

Scott Garrison – Chief Operating Officer

During his tenure at CleanSpark, Garrison has led the Company's explosive growth in Georgia, developing and managing cross-functional teams to build the company's immersion-cooled data center in Norcross, GA, the 50 MW expansion in Washington, GA, and the recent 150 MW expansion in Sandersville, GA. Not limited to construction, Garrison has also played a key role in developing CleanSpark's relationships with the cities, counties, utility providers, local trades and community leaders that have contributed to CleanSpark's track record of success. Garrison will continue to oversee the Company's strategic growth initiatives as the company looks for additional accretive opportunities. He will also be taking on the additional task of managing and supporting the teams behind the operations of CleanSpark's diverse portfolio of data centers.

Before joining CleanSpark in October 2020, Garrison spent the prior three decades of his professional experience leading cross-functional teams. He founded Linq360 and The Integration Center in Las Vegas, delivering technology solutions to businesses around the world. During that time, he partnered and consulted with renowned companies including HP, Verizon, Microsoft, and Samsung. In a prior career, he achieved Class A status with the PGA of America. Scott has served on the Make-A-Wish Advisory Board Southern Nevada, Home Means Nevada for the State of Nevada, the UNLV Advisory Board to Guide the Small Business Development Center, and First Tee of Southern Nevada.

"It is an honor to be part of a company that prioritizes culture," said Garrison. "This is the greatest work family I have ever experienced. I can't wait to get up every morning and go to work. CleanSpark has created the best teams and partners in the world."

Taylor Monnig – Chief Technology Officer

Monnig has developed and led CleanSpark's mining operations teams and the technology that supports them. He's also led successful efforts to improve fleet efficiency through software and hardware upgrades, all while supporting a near perfect uptime at the Company's data centers. Mostly recently, Monnig led the development of a state-of-the-art control and analytics room at the company's headquarters in Henderson, Nevada, which will be home to the core technology team and allow them to remotely monitor the Company's growing portfolio of data centers. In his new role, Monnig will continue to develop the company's tech stack, leading the teams responsible for keeping CleanSpark on the cutting edge as it works toward its goal of running the most efficient fleet of bitcoin miners in the industry. These teams of engineers and developers will support the Company's operations teams with a focus on automation and uptime.

Prior to CleanSpark, Monnig co-founded TMGCore and served as the chief operating officer. In that role, he worked to develop and commercialize single phase and two-phase cooling technologies for high performance computing and bitcoin mining, which earned him a well-earned reputation for his deep expertise in immersion cooling. He holds a bachelor's degree in mass communication from Arizona State University.

"I'm excited to continue spearheading our groundbreaking efforts in the bitcoin mining industry," said Monnig. "The team has done an incredible job of harnessing innovation to drive efficiency, carving a path of unprecedented growth. Our vision of the future is one of sustainability and technology plays a pivotal role in helping that become a reality."

CleanSpark | www.cleanspark.com

Linux Foundation Energy (LF Energy), the open source foundation focused on harnessing the power of collaborative software and hardware technologies to accelerate the energy transition, is pleased to announce that Hydro-Québec, the largest power utility in Canada, and a major player in the global hydropower industry, has joined the foundation as a General Member. LF Energy members provide funding and resources to support the foundation’s mission of building a unified approach to developing non-differentiating code that can enable utilities, grid operators, electric vehicle makers, sophisticated energy buyers and others to develop and implement technologies to transform the power sector.

Hydro-Québec has already collaborated with LF Energy by evaluating the potential for deploying LF Energy projects on its infrastructure. The decision to become a General Member demonstrates Hydro-Québec’s commitment to building and using open source solutions to drive the energy transition forward and ensure interoperability, reliability, and security of the power grid in Québec.

Hydro-Québec is the first North American power utility to join LF Energy. They join European electrical utilities Alliander (Netherlands), Energinet (Denmark), RTE (France), Statnett (Norway), TenneT (Germany and Netherlands), and Vattenfall (Sweden). Other LF Energy members include technology companies such as Google and Microsoft, energy generators such as Shell, equipment vendors such as Aveva and GE, government agencies such as ENTSO-E and NREL, nonprofits such as EnergyTag and EPRI, and research universities such as Stanford and TU Delft.

“Onboarding Hydro-Québec as an LF Energy is a big deal for the power sector in North America, and the energy transition globally,” said LF Energy Executive Director Alex Thornton. “Being able to deeply collaborate with a highly innovative North American utility will provide tremendous value to LF Energy’s portfolio of open source technologies for the sector. We look forward to working more closely with Hydro-Québec as they, like all electric utilities globally, navigate the energy transition to decarbonize operations while ensuring reliability, safety and affordability.”

“Hydro-Québec needs to give itself the means to achieve its ambitions if it is to succeed with its 2035 action plan, and joining the LF Energy offers opportunities to be seized,” says Sébastien Lussier, from Hydro-Québec's research center. “The energy transition involves many challenges and technological hurdles. Joining the LF Energy ecosystem will help Hydro-Québec in its innovation process to better respond to the energy transition, while sharing its know-how and expertise with the energy market and helping to decarbonize it.”

Linux Foundation Energy | Linux Foundation Energy

Nautilus Solar Energy, LLC (“Nautilus”), on behalf of its affiliate Nautilus US Power Holdco, LLC (“NUPH”), and TurningPoint Energy (“TPE”) announce their partnership on a 29.3-megawatt (MW) portfolio of community solar projects in Illinois. The portfolio of four community solar projects, located in Kankakee and Livingston counties, is projected to be operational by 2025. This collaboration strengthens the foothold of Nautilus in community solar, particularly its rapid growth in Illinois and is the first demonstration of TPE’s commitment to invest over $500MM in the Illinois Community Solar market.

The portfolio of projects is qualified under Illinois’ community solar program and helps support the state’s renewable energy goal of 40% by 2030 and 50% by 2040.

“We are thrilled to work with TPE on yet another transaction, the first in the Illinois market. Strategic partnerships like this play a pivotal role in expanding Nautilus's capabilities and reaffirm our position as a leading community solar company with projects and subscribers located across the country," said Eric Paul, Vice President of Partner Development at Nautilus Solar Energy.

”In 2022 we made a commitment to Illinois that we would bring over half a billion of investment in the community solar market,” said Salar Naini, President of TurningPoint Energy. “This collaboration with Nautilus is the start of that commitment, with many more dollars of investment set to flow to the state in the coming years.”

Nautilus will be the long-term owner of the projects and is responsible for overseeing construction, maintaining its long-term performance, and acquiring and managing customer subscriptions. The projects will enable ComEd customers to save on their electric bills while supporting the expansion of renewable energy and Illinois’ ambitious clean energy goals. Combined, the projects will generate clean energy to serve the energy needs of over 3,000 homes and 100 commercial businesses. The four projects will also create construction and ongoing operational jobs along with collaboration and investment into local Illinois businesses on legal, permitting, engineering, construction, and related activities to support these developments.

Additionally, TPE makes charitable community investment commitments in each of its community solar project communities. For these four projects, TPE has designated $75,000 in planned donations to local Kankakee County and Livingston County organizations. Nautilus will match TPE’s commitment for a combined $150,000 in community investment donations on this transaction alone.

Community solar programs are one of the fastest-growing sectors of the renewable energy industry, providing locally produced, affordable clean energy to residents and businesses. The development of community solar projects drives engagement and collaboration in communities through job creation, economic development, and responsible land use.

Nautilus Solar | https://nautilussolar.com/

Tigo Energy, Inc. (NASDAQ: TYGO), a leading provider of intelligent solar and energy software solutions, announced the newest additions to the Tigo Flex MLPE product family, the Tigo TS4-X line. Designed to serve the commercial and industrial (C&I) as well as utility solar markets, Tigo TS4-X products support the latest high-power solar modules, up to 800W. Members of the TS4-X product family feature compatibility with Pure Signal™ technology in Tigo RSS Transmitters and offer a Multi-Factor Rapid Shutdown (MFRS) option with redundant safety signaling for solar systems serving the food and pharmaceutical cold-chain sectors, or other energy-critical applications. The new devices pair with an industry-leading list of third-party solar inverters to deliver design and installation flexibility for solar installers and engineering, procurement, and construction specialists (EPCs).

As Levelized Cost Of Energy (LCOE) continues to drive the large-scale solar sectors, the TS4-X product line gives installers more freedom to deploy the modules that deliver the power and performance for their customer deployments and reduces labor costs with a no-bolt design and no need for additional ground wiring. The new products are the TS4-X-O with optimization and advanced module-level monitoring, the TS4-X-S with advanced monitoring, and the rapid shutdown-only TS4-X-F, all of which feature:

As Levelized Cost Of Energy (LCOE) continues to drive the large-scale solar sectors, the TS4-X product line gives installers more freedom to deploy the modules that deliver the power and performance for their customer deployments and reduces labor costs with a no-bolt design and no need for additional ground wiring. The new products are the TS4-X-O with optimization and advanced module-level monitoring, the TS4-X-S with advanced monitoring, and the rapid shutdown-only TS4-X-F, all of which feature:

Tigo TS4-X MLPE devices are IEC and UL certified for global acceptance and are compliant with NEC 2017 and 2020 690.12 Rapid Shutdown specifications when installed with the Tigo RSS Transmitter and UL PVRSS-certified inverter or an inverter with a built-in Tigo-certified transmitter. With reliable frame mounting requiring only 10 seconds for installation, TS4-X devices include industry-standard MC4 connectors with an IP68 enclosure rating for maximum durability.

“The installers operating at the cutting edge of solar are pushing the envelope on system output as well as cost, and the TS4-X closes an important gap at the top end of the module performance spectrum,” said Jing Tian, chief growth officer at Tigo Energy. “As the solar industry evolves, Tigo Energy remains at the forefront of providing solutions that empower installers and developers. With safety, versatility, and compatibility at its core, the TS4-X is an advancement in MLPE technology, aligning with Tigo's commitment to innovative software, total quality solar, and customer satisfaction.”

Tigo TS4-X devices work seamlessly with previous TS4 Flex MLPE devices, Tigo Cloud Connect Advanced (CCA) data logging devices, and Tigo RSS Transmitters, and are UL PVRSS certified with hundreds of inverter models from leading manufacturers to deliver safety, versatility, and compatibility. To learn more about the TS4-X product line, visit: https://www.tigoenergy.com/ts4-x. TS4-X products are available for purchase today - contact the Tigo sales team for additional details: https://www.tigoenergy.com/contacts

Tigo Energy | www.tigoenergy.com

Ryder System, Inc. (NYSE: R), a leader in supply chain, dedicated transportation, and fleet management solutions, releases a quantitative analysis of the potential economic impacts of converting commercial diesel vehicles to electric vehicles (EV) in today’s market. With evolving state and federal legal requirements aimed at transitioning fleets to zero-emission vehicles, Ryder customers frequently ask about the costs, benefits, and complexities of converting to electric – as EV technology and charging infrastructure are still developing. As a result, Ryder published “Charged Logistics: The Cost of Electric Vehicle Conversion for U.S. Commercial Fleets.”

Based on representative network loads and routes from Ryder’s dedicated fleet operations in today’s market and other factors, the data shows the annual total cost to transport (TCT) by EV versus diesel is estimated to increase across the board – ranging from up to 5% for a light-duty transit van to as much as 114% for a heavy-duty tractor (depending on the geographic area). And, for a mixed fleet of 25 light-, medium- and heavy-duty vehicles, the analysis shows an increased TCT of up to 67% for an all-electric fleet.

“While Ryder is actively deploying EVs and charging infrastructure where it makes sense for customers today, we are not seeing significant adoption of this technology,” says Robert Sanchez, chairman and CEO of Ryder. “For many of our customers, the business case for converting to EV technology just isn’t there yet, given the limitations of the technology and lack of sufficient charging infrastructure. With regulations continuing to evolve, we wanted to better understand the potential impacts to businesses and consumers if companies were required to transition to EV in today’s market.”

Methodology

Ryder examined the TCT for diesel engines versus electric technology in the light-, medium-, and heavy-duty vehicle classes. The analysis is based on representative network loads and routes from Ryder’s dedicated fleet operations, which includes more than 13,000 commercial vehicles and professional drivers. It factors in the cost of the vehicle, maintenance, drivers, range, payload, and diesel fuel versus electricity, while also accounting for EV charging time and equivalent delivery times. The analysis also assumes the accessibility and use of the fastest applicable commercial vehicle chargers – though this network infrastructure is not yet built out.

First, Ryder conducted one-to-one comparisons for diesel and EV transit vans, straight trucks, and heavy-duty tractors, using cost assumptions from California, which typically has the highest fuel, electricity, and labor costs in the country, and in Georgia, where costs are generally lower.

Second, as most companies have more than one vehicle, Ryder applied the individual costs to a fleet of 25 vehicles of mixed classes and types, and compared the cost of owning and operating that fleet in California and Georgia. The fleet mix is based on the overall mix of commercial vehicles in the U.S., according to third-party data (Polk Data Services), and includes 11 light-duty vans, four medium-duty straight trucks, and 10 heavy-duty tractors.

TCT Impact in California: One-to-One Comparison

For California, one-to-one comparisons of various classes and types of commercial diesel vehicles versus their EV counterparts show the annual TCT for EVs increases across the board.

TCT Impact in Georgia: One-to-One Comparison

In Georgia, Ryder conducted the same one-to-one comparisons. However, the variance in TCT for a diesel vehicle versus an EV is greater. Operating EVs in Georgia results in a higher cost disadvantage than in California, because Georgia’s lower fuel and energy costs do not provide the same level of savings when transitioning from fuel to electricity.

TCT Impact in California and Georgia: Mixed Fleet

Ryder then applied the TCT for individual vehicles to a mixed fleet of 25 light-, medium-, and heavy-duty commercial vehicles operating in California versus Georgia, including the assumption that a company would need nearly two heavy-duty EV tractors and more than two drivers to haul the same load on the same route as one heavy-duty diesel tractor.

In this scenario, a company converting 10 heavy-duty diesel tractors would need nearly 19 EVs and 21 drivers in order to provide the same level of service. This increases the total number of vehicles in the fleet from 25 to nearly 34 and drivers from 27 to nearly 36. Therefore:

Inflationary Impact

Ryder’s analysis also considers the potential inflationary impact if companies were required to convert to electric vehicles today. Based on the TCT for a mixed EV fleet, and assuming companies pass the increased TCT on to consumers, Ryder estimates those increases could cumulatively add 0.5% to 1% to overall inflation.

Key Takeaways

“There are specific applications where EV adoption makes sense today, but the use cases are still limited. Yet we’re facing regulations aimed at accelerating broader EV adoption when the technology and infrastructure are still developing,” says Karen Jones, EVP and head of new product development for Ryder. “Until the gap in TCT for heavier duty vehicles is narrowed or closed, we cannot expect many companies to make the transition; and, if required to convert in today’s market, we face more supply chain disruptions, transportation cost increases, and additional inflationary pressure.”

“While mass adoption of EVs is not being required at this time, the purpose of this analysis was to quantify the gap in the total cost to transport goods with diesel versus electric vehicles and to understand what it will take to make commercial EVs economically viable at scale,” adds Sanchez. “Today, it would require significant advancements in EV technology to improve range and payload, and according to at least one industry estimate, nearly $1 trillion in charging infrastructure and power grid upgrades. While EV technology is still evolving, we are evaluating multiple ways to reduce emissions, including electric, natural gas, hydrogen, hybrids, and carbon capture, as well as continuing to advance diesel emissions technology. When a new technology is ready for the market, it has been our experience that businesses will see the benefits and broader adoption will follow.”

Ryder’s EV Solutions

As one of the largest and longest-running fleet owners in North America, with more than 90 years of experience in transportation, Ryder manages a fleet of nearly 250,000 commercial vehicles. The company has introduced EVs into its lease and rental fleets and continues to work with multiple vehicle manufacturers to provide new electric solutions to customers. Ryder also recently launched RyderElectric+, which provides electrification advisors, vehicles, charging, telematics, and maintenance to help facilitate the seamless adoption of EVs.

Ryder System | www.ryder.com

Bidgely and Avista Utilities have been awarded the 2024 Technology Pioneer Award by Peak Load Management Alliance (PLMA) for the integration of Bidgely’s UtilityAI Platform into Avista’s grid management and customer experience strategies. PLMA's annual awards recognize notable innovations in flexible load management and highlight the dedicated teams driving progress towards greater grid stability and reliability.

“We congratulate Bidgely and Avista Utilities, winners of PLMA’s 2024 Technology Pioneer Award, for their collaborative work that leverages AI technology to analyze customer consumption and provide energy insights that validate utility expectations for customers with EVs,” said Kevin Knight, PLMA Awards Program Co-Chair. “This commendable project showcases how AI technology can be a tool used to enhance grid planning, load management, and customer engagement. We look forward to learning more about their results and lessons learned when they present these in a webinar to PLMA stakeholders later this year.”

Avista’s application of Bidgely’s AI-powered data analytics was specifically recognized for transforming multiple dimensions of consumer usage data (via smart meters) into sophisticated energy insights that optimized Avista’s existing grid infrastructure and load forecasting. PLMA also acknowledged the partnership’s demonstrated potential to scale, specifically Bidgely’s light technology footprint and non-invasive monitoring approach.

“Energy consumption is evolving. The more we understand these changes the better we can serve our customers, manage grid loads and improve operational efficiencies,” said Latisha Hill, vice president community affairs and Chief Customer Officer at Avista. “We are honored by PLMA’s recognition for our use of Bidgely’s AI-powered energy insights as a catalyst for innovation organization-wide.”

Notably, Bidgely’s appliance-level energy insights led to data-driven discoveries cross-departmentally at Avista. As a result, the utility was able to reduce the time required to resolve customer calls, reduce high bill investigation truck rolls, improve customer engagement satisfaction ratings, enhance electric vehicle (EV) and distributed energy resources grid planning, as well as save hundreds of hours in employee workloads.

“Today’s energy landscape requires utilities to be innately in tune with how new consumption behavior and increased electrification affect the grid,” said Abhay Gupta, CEO of Bidgely. “Utilities are also embracing a culture of knowledge sharing, and Avista proved how a uniform data set can serve as a single source of truth to bolster success across multiple departments.”

To learn about Avista’s data-driven approach to grid management and customer engagement with Bidgely, read the case study: Leveraging Behind the Meter Intelligence for Customer and Grid Operations.

Bidgely | www.bidgely.com

Avista Utilities | https://www.myavista.com/

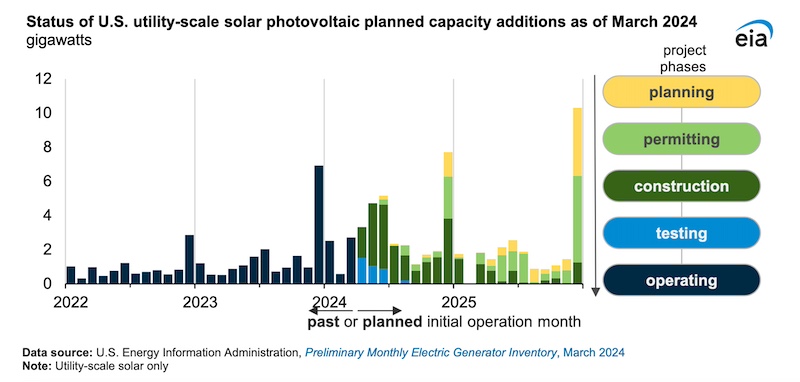

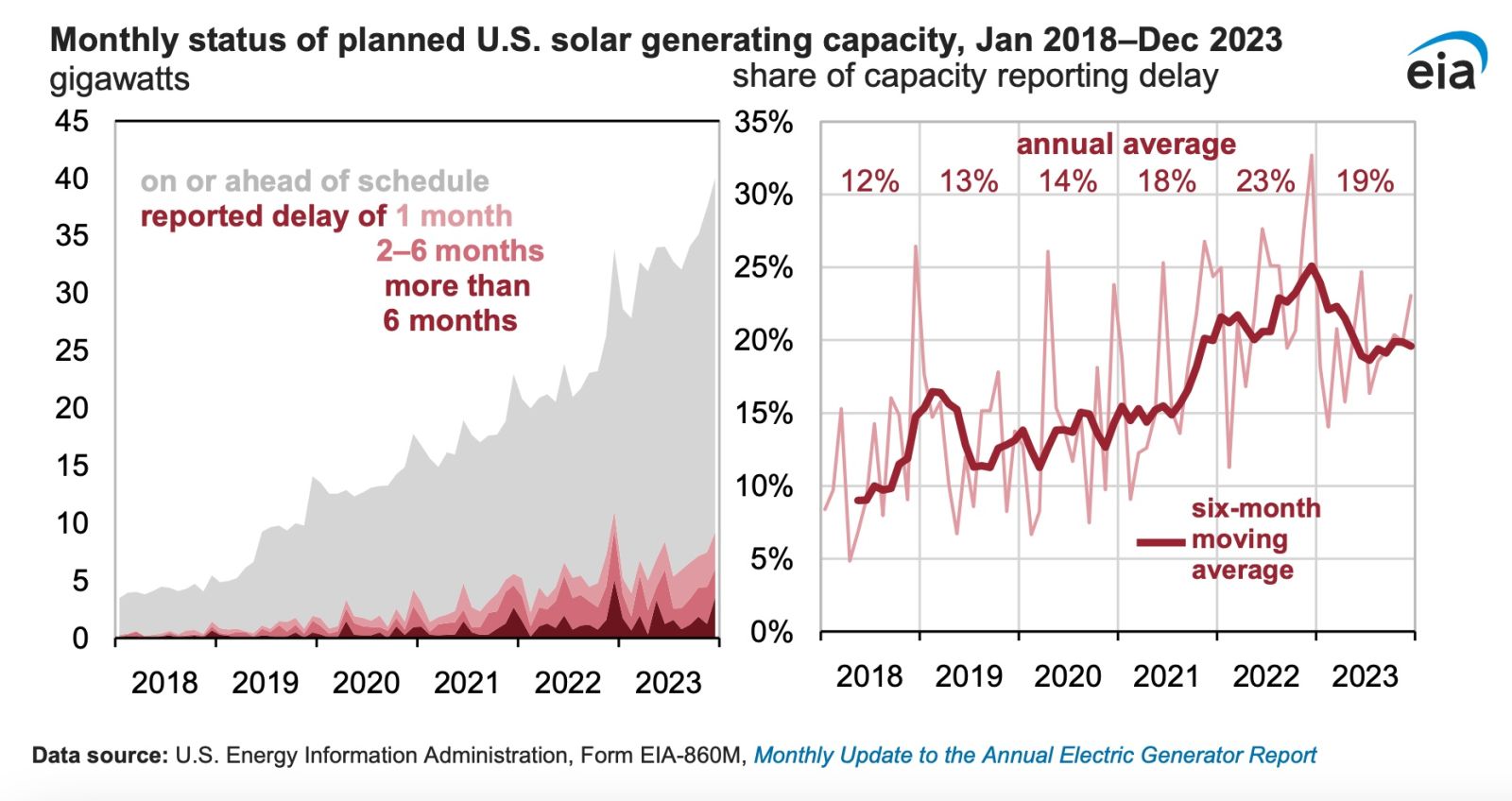

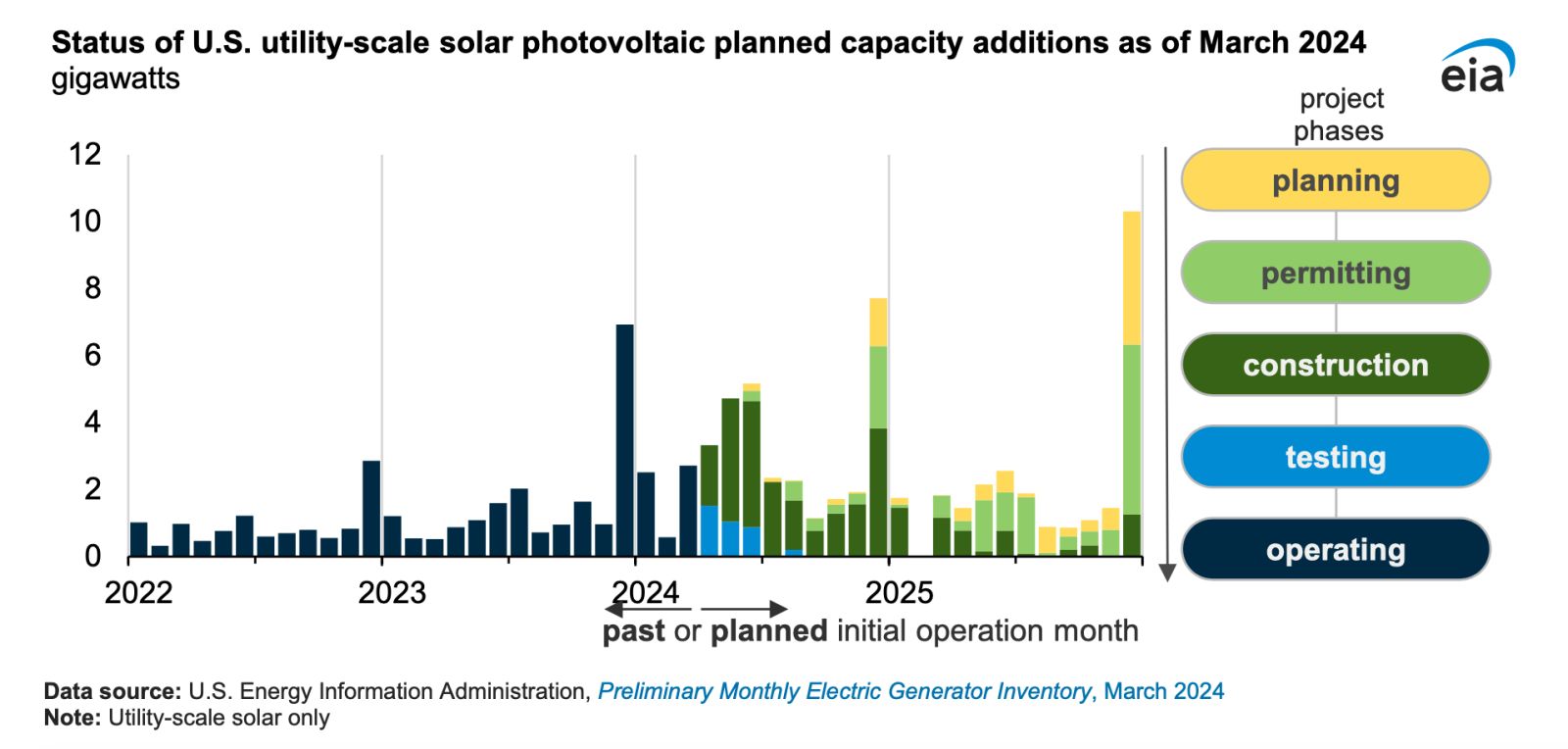

The U.S. electric power sector reported fewer delays to install new utility-scale solar photovoltaic (PV) projects in 2023 than in 2022. In 2023, solar developers pushed back the scheduled online date for an average of 19% of planned solar capacity compared with an average of 23% in 2022. Although the share of solar capacity reporting delays fell in 2023, it was still higher than the average share of delays between 2018 and 2021.

The decrease in delays came at a time when utilities were adding more solar to the grid. In 2023, the electric power sector began operating 19 gigawatts (GW) of new utility-scale solar PV generating capacity, a 27% increase from the existing solar capacity at the end of 2022. Solar power is the fastest-growing source of new electricity generation in the United States because of falling costs, tax credits, and other policies that provide incentives for adding renewable energy sources.

Developers of new power-generating capacity report a project’s initial planned operational date on our Form EIA-860 survey. Beginning 12 months before the planned online date, we ask developers to provide monthly updates on the status and schedule of the project. We maintain the latest information about existing and future U.S. power generators in our Preliminary Monthly Electric Generator Inventory and summaries of capacity by energy source in our Electric Power Monthly.

The number of developers reporting project delays can vary greatly from month to month. However, the percentage of total planned solar capacity with a postponed operational date trended upward throughout 2021 and 2022, reaching a peak at 33% of planned capacity delayed in December 2022. The time between when a planned solar project is first reported on the Form EIA-860 and when the project becomes operational varies considerably. According to an analysis of generator project interconnection timelines by the Lawrence Berkeley National Laboratory, the median length for a solar project is 25 months, from the signing of an interconnection agreement to the commercial operation date.

Projects can be delayed for several reasons, including complications involving permits, construction, or equipment testing. One key factor affecting solar panel installations is the availability of building materials.

U.S. trade policy can also affect solar deployment. U.S. tariffs that affect Chinese manufacturers of solar PV cells and modules in China are suspended by a Presidential Proclamation until June. Once the proclamation expires, imported crystalline silicon from China and certain companies operating in Cambodia, Malaysia, Thailand, and Vietnam will again be subject to tariffs.

Our latest information indicates that the electric power sector added about 6 GW of net summer solar capacity in the first quarter of 2024. For solar projects that developers plan to have operational before the end of 2024, about 24 GW is in the testing or construction phase, and about 6 GW is in the permitting or planning stage. Another 26 GW of new solar capacity is scheduled to come online in 2025, most of which is in the permitting stage.

EIA | www.eia.gov

Alternative Energies May 15, 2023

The United States is slow to anger, but relentlessly seeks victory once it enters a struggle, throwing all its resources into the conflict. “When we go to war, we should have a purpose that our people understand and support,” as former Secretary ....

Unleashing trillions of dollars for a resilient energy future is within our grasp — if we can successfully navigate investment risk and project uncertainties.

The money is there — so where are the projects?

A cleaner and more secure energy future will depend on tapping trillions of dollars of capital. The need to mobilize money and markets to enable the energy transition was one of the key findings of one of the largest studies ever conducted among the global energy sector C-suite. This will mean finding ways to reduce the barriers and uncertainties that prevent money from flowing into the projects and technologies that will transform the energy system. It will also mean fostering greater collaboration and alignment among key players in the energy space.

Interestingly, the study found that insufficient access to finance was not considered the primary cause of the current global energy crisis. In fact, capital was seen to be available — but not being unlocked. Why is that? The answer lies in the differing risk profiles of energy transition investments around the world. These risks manifest in multiple ways, including uncertainties relating to project planning, public education, stakeholder engagement, permitting, approvals, policy at national and local levels, funding and incentives, technology availability, and supply chains.

Interestingly, the study found that insufficient access to finance was not considered the primary cause of the current global energy crisis. In fact, capital was seen to be available — but not being unlocked. Why is that? The answer lies in the differing risk profiles of energy transition investments around the world. These risks manifest in multiple ways, including uncertainties relating to project planning, public education, stakeholder engagement, permitting, approvals, policy at national and local levels, funding and incentives, technology availability, and supply chains.

These risks need to be addressed to create more appealing investment opportunities for both public and private sector funders. This will require smart policy and regulatory frameworks that drive returns from long-term investment into energy infrastructure. It will also require investors to recognize that resilient energy infrastructure is more than an ESG play — it is a smart investment in the context of doing business in the 21st century.

Make de-risking investment profiles a number one priority

According to the study, 80 percent of respondents believe the lack of capital being deployed to accelerate the transition is the primary barrier to building the infrastructure required to improve energy security. At the same time, investors are looking for opportunities to invest in infrastructure that meets ESG and sustainability criteria. This suggests an imbalance between the supply and demand of capital for energy transition projects.

How can we close the gap?

One way is to link investors directly to energy companies. Not only would this enable true collaboration and non-traditional partnerships, but it would change the way project financing is conceived and structured — ultimately aiding in potentially satisfying the risk appetite of latent but hugely influential investors, such as pension funds. The current mismatch of investor appetite and investable projects reveals a need for improving risk profiles, as well as a mindset shift towards how we bring investment and developer stakeholders together for mutual benefit. The circular dilemma remains: one sector is looking for capital to undertake projects within their skill to deploy, while another sector wonders where the investable projects are.

This conflict is being played out around the world; promising project announcements are made, only to be followed by slow progress (or no action at all). This inertia results when risks are compounded and poorly understood. To encourage collaboration between project developers and investors with an ESG focus, more attractive investment opportunities can be created by pulling several levers: public and private investment strategies, green bonds and other sustainable finance instruments, and innovative financing models such as impact investing.

Expedite permitting to speed the adoption of new technologies

Another effective strategy to de-risk investment profiles is found in leveraging new technologies and approaches that reduce costs, increase efficiency, and enhance the reliability of energy supply. Research shows that 62 percent of respondents indicated a moderate or significant increase in investment in new and transitional technologies respectively, highlighting the growing interest in innovative solutions to drive the energy transition forward.

Hydrogen, carbon capture and storage, large-scale energy storage, and smart grids are some of the emerging technologies identified by survey respondents as having the greatest potential to transform the energy system and create new investment opportunities. However, these technologies face challenges such as long lag times between conception and implementation.

If the regulatory environment makes sense, then policy uncertainty is reduced, and the all-important permitting pathways are well understood and can be navigated. Currently, the lack of clear, timely, and fit-for-purpose permitting is a major roadblock to the energy transition. To truly unleash the potential of transitional technologies requires the acceleration of regulatory systems that better respond to the nuance and complexity of such technologies (rather than the current one-size-fits all approach). In addition, permitting processes must also be expedited to dramatically decrease the period between innovation, commercialization, and implementation. One of the key elements of faster permitting is effective consultation with stakeholders and engagement with communities where these projects will be housed for decades. This is a highly complex area that requires both technical and communication skills.

The power of collaboration, consistency, and systems thinking

The report also reveals the need for greater collaboration among companies in the energy space to build a more resilient system. The report shows that, in achieving net zero, there is a near-equal split between those increasing investment (47 percent of respondents), and those decreasing investment (39 percent of respondents). This illustrates the complexity and diversity of the system around the world. A more resilient system will require all its components – goals and actions – to be aligned towards a common outcome.

Another way to de-risk the energy transition is to establish consistent, transparent, and supportive policy frameworks that encourage investment and drive technological innovation. The energy transition depends on policy to guide its direction and speed by affecting how investors feel and how the markets behave. However, inconsistent or inadequate policy can also be a source of uncertainty and instability. For example, shifting political priorities, conflicting international standards, and the lack of market-based mechanisms can hinder the deployment of sustainable technologies, resulting in a reluctance to commit resources to long-term projects.

Variations in country-to-country deployment creates disparities in energy transition progress. For instance, the 2022 Inflation Reduction Act in the US has posed challenges for the rest of the world, by potentially channeling energy transition investment away from other markets and into the US. This highlights the need for a globally unified approach to energy policy that balances various national interests while addressing a global problem.

To facilitate the energy transition, it is imperative to establish stable, cohesive, and forward-looking policies that align with global goals and standards. By harmonizing international standards, and providing clear and consistent signals, governments and policymakers can generate investor confidence, helping to foster a robust energy ecosystem that propels the sector forward.

Furthermore, substantive and far-reaching discussions at international events like the United Nations Conference of the Parties (COP), are essential to facilitate this global alignment. These events provide an opportunity to de-risk the energy transition through consistent policy that enables countries to work together, ensuring that the global community can tackle the challenges and opportunities of the energy transition as a united front.

Keeping net-zero ambitions on track

Despite the challenges faced by the energy sector, the latest research reveals a key positive: 91 percent of energy leaders surveyed are working towards achieving net zero. This demonstrates a strong commitment to the transition and clear recognition of its importance. It also emphasizes the need to accelerate our efforts, streamline processes, and reduce barriers to realizing net-zero ambitions — and further underscores the need to de-risk energy transition investment by removing uncertainties.

The solution is collaborating and harmonizing our goals with the main players in the energy sector across the private and public sectors, while establishing consistent, transparent, and supportive policy frameworks that encourage investment and drive technological innovation.

These tasks, while daunting, are achievable. They require vision, leadership, and action from all stakeholders involved. By adopting a new mindset about how we participate in the energy system and what our obligations are, we can stimulate the rapid progress needed on the road to net zero.

Dr. Tej Gidda (Ph.D., M.Sc., BSc Eng) is an educator and engineer with over 20 years of experience in the energy and environmental fields. As GHD Global Leader – Future Energy, Tej is passionate about moving society along the path towards a future of secure, reliable, and affordable low-carbon energy. His focus is on helping public and private sector clients set and deliver on decarbonization goals in order to achieve long-lasting positive change for customers, communities, and the climate. Tej enjoys fostering the next generation of clean energy champions as an Adjunct Professor at the University of Waterloo Department of Civil and Environmental Engineering.

GHD | www.ghd.com

The Kincardine floating wind farm, located off the east coast of Scotland, was a landmark development: the first commercial-scale project of its kind in the UK sector. Therefore, it has been closely watched by the industry throughout its installation. With two of the turbines now having gone through heavy maintenance, it has also provided valuable lessons into the O&M processes of floating wind projects.

In late May, the second floating wind turbine from the five-turbine development arrived in the port of Massvlakte, Rotterdam, for maintenance. An Anchor Handling Tug Supply (AHTS)

vessel was used to deliver the KIN-02 turbine two weeks after a Platform Supply Vessel (PSV) and AHTS had worked to disconnect the turbine from the wind farm site. The towing vessel became the third vessel used in the operation.

This is not the first turbine disconnected from the site and towed for maintenance. In the summer of 2022, KIN-03 became the world’s first-ever floating wind turbine that required heavy maintenance (i.e. being disconnected and towed for repair). It was also towed from Scotland to Massvlakte.

Each of these operations has provided valuable lessons for the ever-watchful industry in how to navigate the complexities of heavy maintenance in floating wind as the market segment grows.

The heavy maintenance process

When one of Kincardine’s five floating 9.5 MW turbines (KIN-03) suffered a technical failure in May 2022, a major technical component needed to be replaced. The heavy maintenance strategy selected by the developer and the offshore contractors consisted in disconnecting and towing the turbine and its floater to Rotterdam for maintenance, followed by a return tow and re-connection. All of the infrastructure, such as crane and tower access, remained at the quay following the construction phase. (Note, the following analysis only covers KIN-03, as details of the second turbine operation are not yet available).

Comparing the net vessel days for both the maintenance and the installation campaigns at this project highlights how using a dedicated marine spread can positively impact operations.

For this first-ever operation, a total of 17.2 net vessel days were required during turbine reconnection—only a slight increase on the 14.6 net vessel days that were required for the first hook-up operation performed during the initial installation in 2021. However, it exceeds the average of eight net vessel days during installation. The marine spread used in the heavy maintenance operation differed from that used during installation. Due to this, it did not benefit from the learning curve and experience gained throughout the initial installation, which ultimately led to the lower average vessel days.

The array cable re-connection operation encountered a similar effect. The process was performed by one AHTS that spent 10 net vessel days on the operation. This compares to the installation campaign, where the array cable second-end pull-in lasted a maximum of 23.7 hours using a cable layer.

Overall, the turbine shutdown duration can be broken up as 14 days at the quay for maintenance, 52 days from turbine disconnection to turbine reconnection, and 94 days from disconnection to the end of post-reconnection activities.

What developers should keep in mind for heavy maintenance operations

This analysis has uncovered two main lessons developers should consider when planning a floating wind project: the need to identify an appropriate O&M port, and to guarantee that a secure fleet is available.

Floating wind O&M operations require a port with both sufficient room and a deep-water quay. The port must also be equipped with a heavy crane with sufficient tip height to accommodate large floaters and reach turbine elevation. Distance to the wind farm should also be taken into account, as shorter distances will reduce towing time and, therefore, minimize transit and non-productive turbine time.

During the heavy maintenance period for KIN-03 and KIN-02, the selected quay (which had also been utilized in the initial installation phase of the wind farm project), was already busy as a marshalling area for other North Sea projects. This complicated the schedule significantly, as the availability of the quay and its facilities had to be navigated alongside these other projects. This highlights the importance of abundant quay availability both for installation (long-term planning) and maintenance that may be needed on short notice.

At the time of the first turbine’s maintenance program (June 2022), the North Sea AHTS market was in an exceptional situation: the largest bollard pull AHTS units contracted at over $200,000 a day, the highest rate in over a decade.

During this time, the spot market was close to selling out due to medium-term commitments, alongside the demand for high bollard pull vessels for the installation phase at a Norwegian floating wind farm project. The Norwegian project required the use of four AHTS above a 200t bollard pull. With spot rates ranging from $63,000 to $210,000 for the vessels contracted for Kincardine’s maintenance, the total cost of the marine spread used in the first repair campaign was more than $4 million.

Developers should therefore consider the need to structure maintenance contracts with AHTS companies, either through frame agreements or long-term charters, to decrease their exposure to spot market day rates as the market tightens in the future.

While these lessons are relevant for floating wind developers now, new players are looking towards alternative heavy O&M maintenance options for the future. Two crane concepts are especially relevant in this instance. The first method is for a crane to be included in the turbine nacelle to be able to directly lift the component which requires repair from the floater, as is currently seen on onshore turbines. This method is already employed in onshore turbines and could be applicable for offshore. The second method is self-elevating cranes with several such solutions already in development.

The heavy maintenance operations conducted on floating turbines at the Kincardine wind farm have provided invaluable insights for industry players, especially developers. The complex process of disconnecting and towing turbines for repairs highlights the need for meticulous planning and exploration of alternative maintenance strategies, some of which are already in the pipeline. As the industry evolves, careful consideration of ports, and securing fleet contracts, will be crucial in driving efficient and cost-effective O&M practices for the floating wind market.

Sarah McLean is Market Research Analyst at Spinergie, a maritime technology company specializing in emission, vessel performance, and operation optimization.

Spinergie | www.spinergie.com

According to the Energy Information Administration (EIA), developers plan to add 54.5 gigawatts (GW) of new utility-scale electric generating capacity to the U.S. power grid in 2023. More than half of this capacity will be solar. Wind power and battery storage are expected to account for roughly 11 percent and 17 percent, respectively.

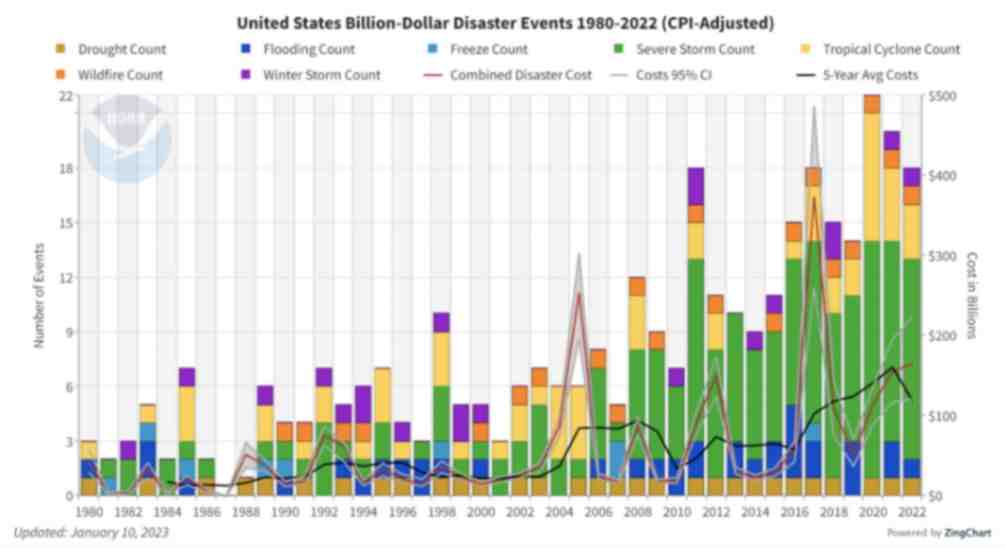

A large percentage of new installations are being developed in areas that are prone to extreme weather events and natural disasters (e.g., Texas and California), including high wind, tornadoes, hail, flooding, earthquakes, wildfires, etc. With the frequency and severity of many of these events increasing, project developers, asset owners, and tax equity partners are under growing pressure to better understand and mitigate risk.

Figure 1. The history of billion-dollar disasters in the United States each year from 1980 to 2022 (source: NOAA)

In terms of loss prevention, a Catastrophe (CAT) Modeling Study is the first step to understanding the exposure and potential financial loss from natural hazards or extreme weather events. CAT studies form the foundation for wider risk management strategies, and have significant implications for insurance costs and coverage.

Despite their importance, developers often view these studies as little more than a formality required for project financing. As a result, they are often conducted late in the development cycle, typically after a site has been selected. However, a strong case can be made for engaging early with an independent third party to perform a more rigorous site-specific technical assessment. Doing so can provide several advantages over traditional assessments conducted by insurance brokerage affiliates, who may not possess the specialty expertise or technical understanding needed to properly apply models or interpret the results they generate. One notable advantage of early-stage catastrophe studies is to help ensure that the range of insurance costs, which can vary from year to year with market forces, are adequately incorporated into the project financial projections.

The evolving threat of natural disasters

Over the past decade, the financial impact of natural hazard events globally has been almost three trillion dollars. In the U.S. alone, the 10-year average annual cost of natural disaster events exceeding $1 billion increased more than fourfold between the 1980s ($18.4 billion) and the 2010s ($84.5 billion).

Investors, insurers, and financiers of renewable projects have taken notice of this trend, and are subsequently adapting their behavior and standards accordingly. In the solar market, for example, insurance premiums increased roughly four-fold from 2019 to 2021. The impetus for this increase can largely be traced back to a severe storm in Texas in 2019, which resulted in an $80 million loss on 13,000 solar panels that were damaged by hail.

The event awakened the industry to the hazards severe storms present, particularly when it comes to large-scale solar arrays. Since then, the impact of convective weather on existing and planned installations has been more thoroughly evaluated during the underwriting process. However, far less attention has been given to the potential for other natural disasters; events like floods and earthquakes have not yet resulted in large losses and/or claims on renewable projects (including wind farms). The extraordinary and widespread effect of the recent Canadian wildfires may alter this behavior moving forward.

A thorough assessment, starting with a CAT study, is key to quantifying the probability of their occurrence — and estimating potential losses — so that appropriate measures can be taken to mitigate risk.

All models are not created equal

Industrywide, certain misconceptions persist around the use of CAT models to estimate losses from an extreme weather event or natural disaster.

Often, the perception is that risk assessors only need a handful of model inputs to arrive at an accurate figure, with the geographic location being the most important variable. While it’s true that many practitioners running models will pre-specify certain project characteristics regardless of the asset’s design (for example, the use of steel moment frames without trackers for all solar arrays in a given region or state), failure to account for even minor details can lead to loss estimates that are off by multiple orders of magnitude.

The evaluation process has recently become even more complex with the addition of battery energy storage. Relative to standalone solar and wind farms, very little real-world experience and data on the impact of extreme weather events has been accrued on these large-scale storage installations. Such projects require an even greater level of granularity to help ensure that all risks are identified and addressed.

Even when the most advanced modeling software tools are used (which allow for thousands of lines of inputs), there is still a great deal that is subject to interpretation. If the practitioner does not possess the expertise or technical ability needed to understand the model, the margin for error can increase substantially. Ultimately, this can lead to overpaying for insurance. Worse, you may end up with a policy with insufficient coverage. In both cases, the profitability of the asset is impacted.

Supplementing CAT studies

In certain instances, it may be necessary to supplement CAT models with an even more detailed analysis of the individual property, equipment, policies, and procedures. In this way, an unbundled risk assessment can be developed that is tailored to the project. Supplemental information (site-specific wind speed studies and hydrological studies, structural assessment, flood maps, etc.) can be considered to adjust vulnerability models.

This provides an added layer of assurance that goes beyond the pre-defined asset descriptions in the software used by traditional studies or assessments. By leveraging expert elicitations, onsite investigations, and rigorous engineering-based methods, it is possible to discretely evaluate asset-specific components as part of the typical financial loss estimate study: this includes Normal Expected Loss (NEL), also known as Scenario Expected Loss (SEL); Probable Maximum Loss (PML), also known as Scenario Upper Loss (SUL); and Probabilistic Loss (PL).

Understanding the specific vulnerabilities and consequences can afford project stakeholders unique insights into quantifying and prioritizing risks, as well as identifying proper mitigation recommendations.

Every project is unique

The increasing frequency and severity of natural disasters and extreme weather events globally is placing an added burden on the renewable industry, especially when it comes to project risk assessment and mitigation. Insurers have signaled that insurance may no longer be the main basis for transferring risk; traditional risk management, as well as site and technology selection, must be considered by developers, purchasers, and financiers.

As one of the first steps in understanding exposure and the potential capital loss from a given event, CAT studies are becoming an increasingly important piece of the risk management puzzle. Developers should treat them as such by engaging early in the project lifecycle with an independent third-party practitioner with the specialty knowledge, tools, and expertise to properly interpret models and quantify risk.

Hazards and potential losses can vary significantly depending on the project design and the specific location. Every asset should be evaluated rigorously and thoroughly to minimize the margin for error, and maximize profitability over its life.

Chris LeBoeuf is Global Head of the Extreme Loads and Structural Risk division of ABS Group, based in San Antonio, Texas. He leads a team of more than 60 engineers and scientists in the US, UK, and Singapore, specializing in management of risks to structures and equipment related to extreme loading events, including wind, flood, seismic and blast. Chris has more than 20 years of professional experience as an engineering consultant, and is a recognized expert in the study of blast effects and blast analysis, as well as design of buildings. He holds a Bachelor of Science in Civil Engineering from The University of Texas at San Antonio, and is a registered Professional Engineer in 12 states.

Chris LeBoeuf is Global Head of the Extreme Loads and Structural Risk division of ABS Group, based in San Antonio, Texas. He leads a team of more than 60 engineers and scientists in the US, UK, and Singapore, specializing in management of risks to structures and equipment related to extreme loading events, including wind, flood, seismic and blast. Chris has more than 20 years of professional experience as an engineering consultant, and is a recognized expert in the study of blast effects and blast analysis, as well as design of buildings. He holds a Bachelor of Science in Civil Engineering from The University of Texas at San Antonio, and is a registered Professional Engineer in 12 states.

ABS Group | www.abs-group.com

Throughout my life and career as a real estate developer in New York City, I’ve had many successes. In what is clearly one of my most unusual development projects in a long career filled with them, I initiated the building of a solar farm to help t....

I’m just going to say it, BIPV is dumb. Hear me out…. Solar is the most affordable form of energy that has ever existed on the planet, but only because the industry has been working towards it for the past 15 years. Governments,....

Heat waves encircled much of the earth last year, pushing temperatures to their highest in recorded history. The water around Florida was “hot-tub hot” — topping 101° and bleaching and killing coral in waters around the peninsula. Phoenix had ....

Wind turbines play a pivotal role in the global transition to sustainable energy sources. However, the harsh environmental conditions in which wind turbines operate, such as extreme temperatures, high humidity, and exposure to various contaminants, p....

Wind energy remains the leading non-hydro renewable technology, and one of the fastest-growing of all power generation technologies. The key to making wind even more competitive is maximizing energy production and efficiently maintaining the assets. ....

The allure of wind turbines is undeniable. For those fortunate enough to visit these engineering marvels, it’s an experience filled with awe and learning. However, the magnificence of these structures comes with inherent risks, making safety an abs....

Battery energy storage is a critical technology to reducing our dependence on fossil fuels and build a low carbon future. Renewable energy generation is fundamentally different from traditional fossil fuel energy generation in that energy cannot be p....

Not enough people know that hydrogen fuel cells are a zero-emission energy technology. Even fewer know water vapor's outsized role in electrochemical processes and reactions. Producing electricity through a clean electrochemical process with water....

In the ever-evolving landscape of sustainable transportation, a ground-breaking shift is here: 2024 ushers in a revolutionary change in Electric Vehicle (EV) tax credits in the United States. Under the Inflation Reduction Act (IRA), a transforma....

Now more than ever, it would be difficult to overstate the importance of the renewable energy industry. Indeed, it seems that few other industries depend as heavily on constant and rapid innovation. This industry, however, is somewhat unique in its e....

University of Toronto’s latest student residence welcomes the future of living with spaces that are warmed by laptops and shower water. In September 2023, one of North America’s largest residential passive homes, Harmony Commons, located....

For decades, demand response (DR) has proven a tried-and-true conservation tactic to mitigate energy usage during peak demand hours. Historically, those peak demand hours were relatively predictable, with increases in demand paralleling commuter and ....